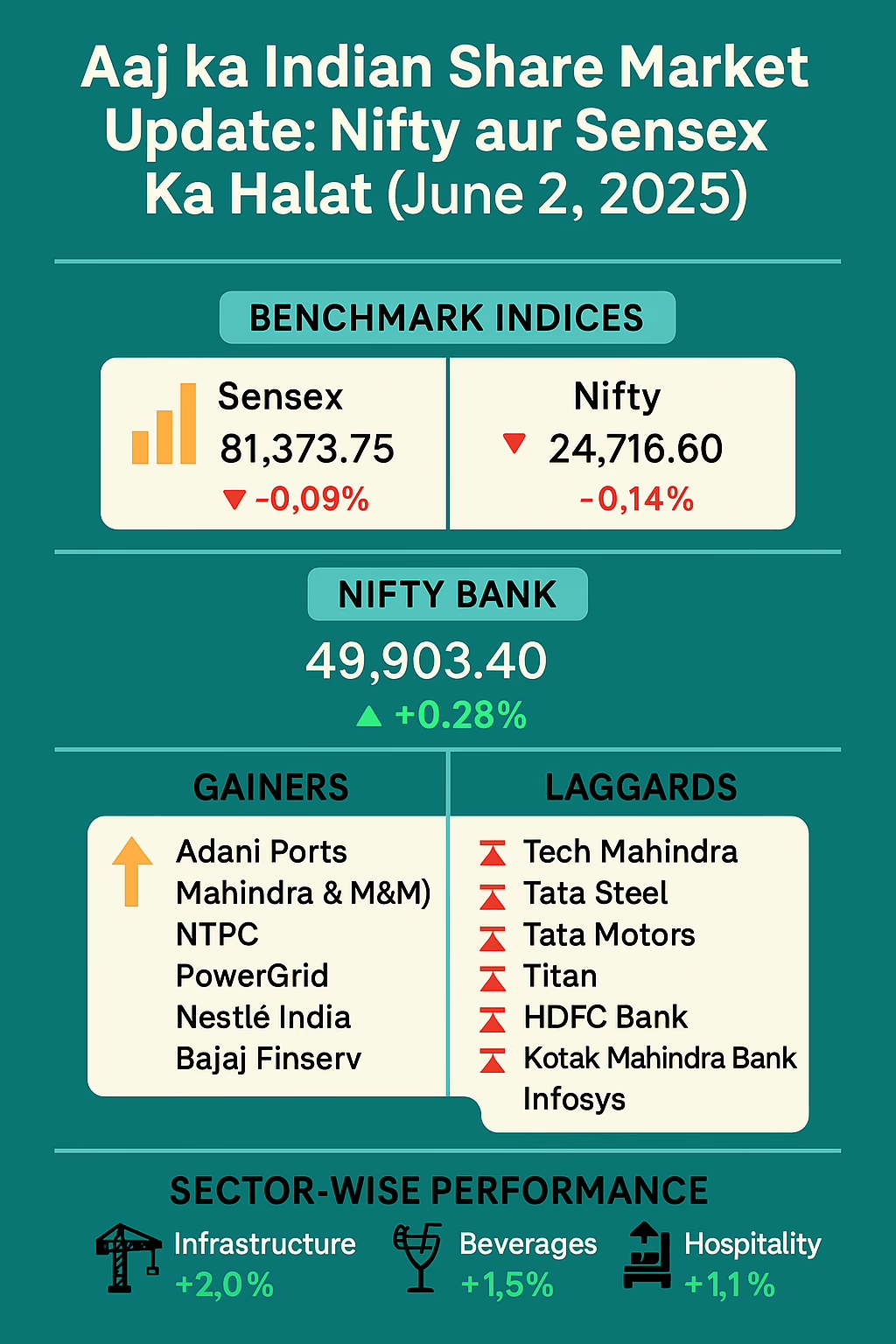

Why the Stock Market Fell Today? Sensex Tanks 636 Points, Nifty Below 24,550 — 6 Key Reasons Behind the Decline

Aaj Indian stock market ka mood kafi negative raha. Sensex today me 636 points ka sharp fall nazar aaya, jisse Sensex tanks 636 points to close at 80,737, aur Nifty below 24,550 level gir gaya, settling at 24,542. Investors puchte hai, “Why did Sensex fall today? Kya wajah bani is market crash ki?” Iss article me hum discuss karenge 6 key reasons behind Sensex tanks 636 points, Nifty below 24,550 —

1. Global Trade Tensions Escalate

Aaj ke stock market crash ka sabse bada reason tha global trade tensions escalate. U.S. President Donald Trump ne announce kiya ki imported steel aur aluminium par tariffs 50% kar diye jayenge, effective June 4, 2025. Yeh move “impact of US steel tariffs on Indian markets” ke perspective se dekha jaye to kafi negative raha. India ne FY25 me $4.5 billion ke steel aur aluminium U.S. ko export kiye the. Tata Steel, Hindalco, JSW Steel jaise Indian metal exporters ko is tariff hike se direct impact face karna padega.

Global trade tensions sirf Pakistan nahi, balki China-U.S. tensions bhi abhi simmering stage me hai. A potential phone call between Trump aur Chinese President Xi Jinping ka speculation chal raha tha, jisse “global trade tensions effect on Sensex” aur bhadka. Stocks of Tata Steel, Hindalco, aur JSW Steel sab under-pressure rahe.

2. Weak Global Economic Data

“Weak global data effect on Sensex” ka dusra kaaran tha recent economic numbers. U.S. manufacturing sector ne third consecutive month contraction show kiya, aur China me factory activity eight months baad pehli baar decline howi. Isse global demand-supply chains disturb hue, jiski wajah se U.S. aur Asian markets dono down hue. Nasdaq aur S&P 500 futures dono 0.5% se zyada gir gaye. Europe me STOXX 600 index 0.45% slip hua, jabki London’s FTSE 100 ne 0.36% decline register kiya.

3. Caution Ahead of RBI Policy Decision

Aaj stock market me RBI policy anticipation June 2025 ka bhi badda factor tha. Rate-sensitive sectors jaise banks, financials, autos, consumer stocks pe selling pressure dekhne ko mili. Investors RBI ki monetary policy meeting ka intezaar kar rahe hai, jahan a 25-basis-point rate cut priced in hai, lekin central bank ke forward guidance aur commentary pe uncertainty thi. Is wajah se log profit-booking kar rahe the.

Nifty Bank aur Financial Services indices dono kareeb 0.7% gir gaye, jabki Auto aur FMCG stocks 0.5% tak slip hue.

4. Rising U.S. Debt and Bond Yields

Ek aur major reason tha “U.S. debt impact on Indian stocks”. U.S. Senate ne $3.8 trillion tax-and-spending bill discuss karne ka decision liya, jab U.S. federal debt $36.2 trillion cross kar chuka tha. Increased government borrowing ki wajah se long-term U.S. bond yields 5% ke critical level ke kareeb pohonch gaye. Higher bond yields ka matlab hota hai ki equities pe selling pressure bada raha hai globally, jisse EM (emerging markets) jaise India me investors risk sell-off karte hai.

5. Oil Price Volatility

“Oil price volatility June 2025 effect Indian markets” ka bhi significant role raha. Brent crude abd $64.58 per barrel pe trade kar raha tha, jabki WTI $62.46 per barrel pe tha. Pichhle session me crude ne nearly 3% gain kiya, kyunki OPEC+ ne July me output increases sirf 411,000 barrels per day rakhne ka decision liya—market ke kuch expectations ke mukable me less tha. Iran nuclear deal se related tensions ne supply outlook par aur clouds create kiye.

India ek bada importer hai, toh oil price volatility direct tarike se trade balance aur fuel inflation ko impact karti hai. Jab crude upar jati hai, import bill bhadhta hai aur inflation pressure badhta hai, jiski wajah se RBI ke liye rate cuts pushback ho sakte hai.

6. Rate Cut Expectations in the U.S.

Last, lekin important, “Fed rate cut September 2025 chances” aur “impact of Fed rate signals on Indian stock market” ko nahi bhool sakte. Fed Governor Christopher Waller ne suggest kiya ki agar upcoming economic data weak aayi, to rate cuts iss saal ho sakte hai. Markets abhi September me 75% chance price kar rahe the, lekin koi firm signal Fed se nahi aaya tha. Is uncertainty se global bond yields upar neechay hoti rahi, aur equity markets pe pressure bana raha.

Conclusion: Market Outlook aur Future Strategy

Aaj ke stock market crash ka analysis karne par saamne aata hai ki multiple factors ne ek saath mil kar “Sensex tanks 636 points” aur “Nifty below 24,550” scenario create kiya. Global trade tensions escalate hue, weak global economic data ne pressure dala, RBI policy anticipation ne caution create kiya, rising U.S. debt aur bond yields ne risk-off sentiment badhaya, oil price volatility se inflation concerns uthe, aur U.S. rate cut expectations se overall uncertainty bani rahi.

Investors ke liye kuch suggestions:

- Diversification: Portfolio me variety rakhna crucial hai.

- Long-Term Focus: Short-term volatility ko ignore karke long-term fundamentals par dhyan dein.

- Stay Informed: Global aur domestic developments regularly track karein.

- Risk Management: Stop-loss use karein aur panic selling se bachein.

Share this content:

Post Comment