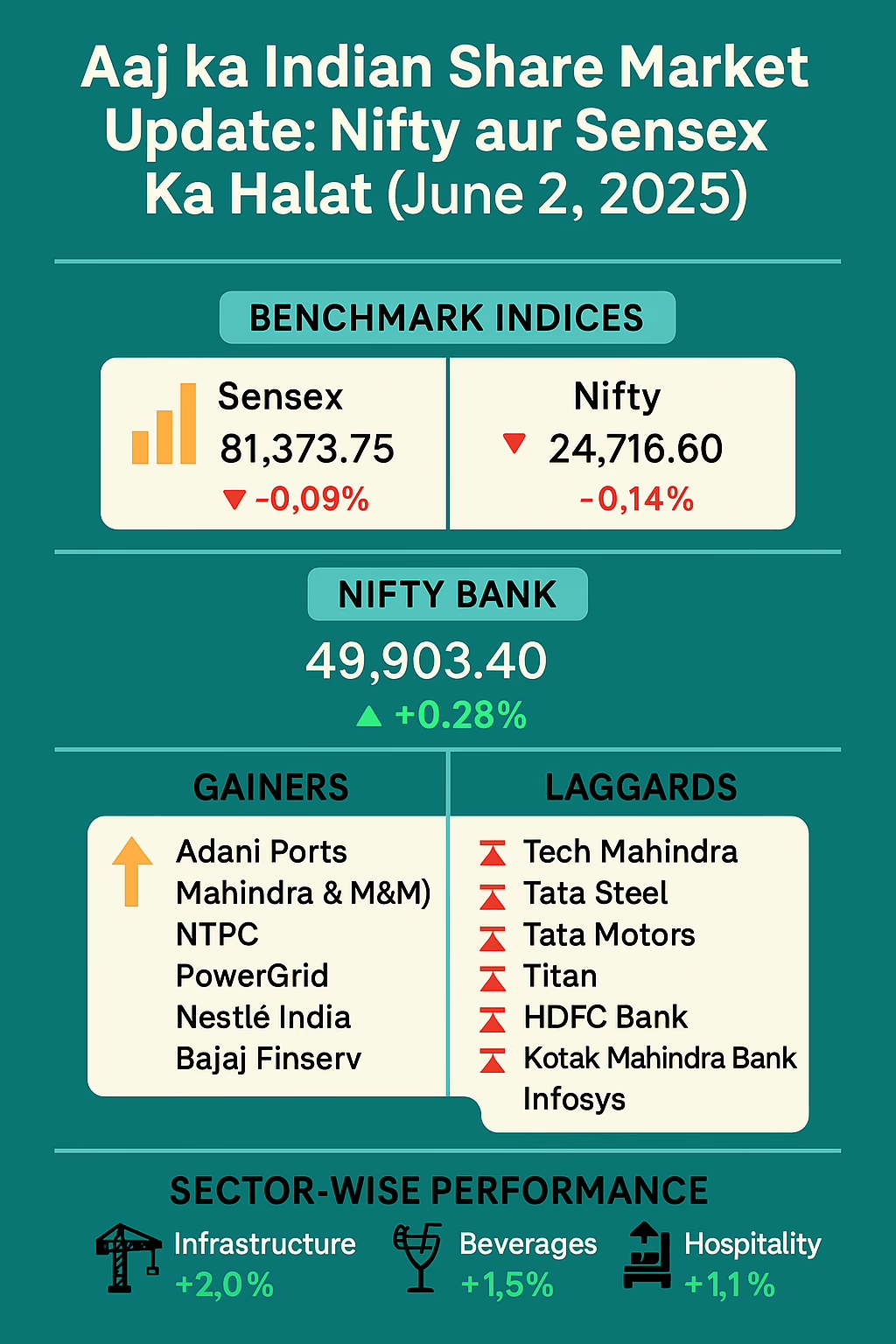

Stock Market Close Highlights: Sensex Up 261 Pts, Nifty at 24,620; SMIDs Gain on Upbeat Global Cues

Aaj ka market close ka scene kaafi positive raha, jahan Sensex ne 260.74 points ka jump dekha aur Nifty bhi 77.70 points se upar gaya, 24,620.20 pe close hua. SMID caps ne global cues se faida uthaya aur rally mein hissedari dikhayi. Isi ke saath, Indian equity indices ne 4 June 2025 ko strong finish kiya, jahan Sensex 80,998.25 pe close hua aur Nifty 24,620.20 pe settle hua. Iss article mein hum poori detail mein baat karenge ki kin karano se aaj ka market positive raha, kaunse sectors shine kiye,

Market Overview: Sensex and Nifty Ka Uthal-Puthal

Aaj ka trading session kaafi interesting raha. Sensex ne 80,737 pe trading shuru kiya aur din ke dauraan hi steady buying pressure dekhne ko mila. Final close mein, Sensex 260.74 points yaani 0.32% ki growth ke saath 80,998.25 pe settle hua. Wahin, Nifty ne bhi accha perform kiya, aur 24,542 ke level se upar hota hua 24,620.20 pe close hua, jo 0.32% ka gain tha.

Global Cues Aur SMID Caps Ka Impact

Aaj global markets ke upbeat cues ne bhi Indian indices ko support kiya. Asia-Pacific markets mein positive sentiment tha, jabki US futures bhi green zone mein trade kar rahe the. Is wajeh se SMID caps (Small-Mid Cap stocks) ko buying interest mila. Hedge funds aur large domestic funds ne SMID stocks mein allocation badhayi, aur isse major indices ko bhi uplift mila.

Key Drivers Behind the Rally

1. US Market Cues: US stock market ne tail-end session mein strong gains show kiye, jahan S&P 500 aur Nasdaq ne record highs touch kiya. Iska direct impact Asia-Pacific securities par pada, aur Indian markets ne bhi follow kiya.

2. Crude Oil Prices Slide: Aaj crude oil prices mein mild decline dekhne ko mila, jisse energy stocks mein relief mila. Crude oil price drop se inflationary concerns reduce hue, jo market participants ke liye ek bullish sign tha.

3. FII Inflows: Foreign Institutional Investors (FIIs) ne aaj net buying show ki, roughly ₹800 crore ke aas-paas. Ye data ne domestic markets ko boost diya aur overall sentiment improve hua.

4. Domestic Macros: RBI ne apne monetary policy stance ko neutral rakhne ka ishara diya, jisse rate hike near-term mein unlikely dikh raha hai. Is announcement ne financial stocks ko support provide kiya.

5. Sectoral Strength: IT, Pharma, aur Banking sectors ne aaj positive movement show ki. Particularly, midcap banking stocks mein buying pressure tha, kyunki quarterly results expectations strong the.

Sectoral Performance: Kiske Shares Uthe Aur Kiska Dil Thoda Dukh

Aaj ka din sector-wise ek mixed bag raha, lekin majority sectors green zone mein close hue. IT sector ne halka sa pressure face kiya kyunki US dollar weakness se concerns the, lekin baki sectors ne achha perform kiya.

- Banking & Financials: Banking stocks ne strong rally dikhaayi. Kotak Mahindra Bank, HDFC Bank, aur ICICI Bank ne 1-2% ke gains book kiye. Bank share price upticks ne broad market ko bhi uplift diya.

- Automobile: Auto majors like Maruti Suzuki, Tata Motors, aur Mahindra & Mahindra ne 0.5-1% gains register kiye. Auto stock tips lene walon ke liye ye achha sign tha.

- Pharma: Pharma stocks mein moderate buying interest tha. Dr. Reddy’s, Sun Pharma, aur Cipla ne 0.5% ke aas-paas gains dikhaye. Pharma share market investors ne back-to-back quarterly performance expect kiya.

- Energy: Oil & Gas sector thoda weak raha kyunki crude prices mein decline aya. Reliance Industries aur ONGC ne halke losses book kiye.

- SMID Caps: Aaj small and mid cap stocks ne sabse zyada shine kiya. Companies jaise Adani Enterprises, PVR, aur PI Industries ne double-digit percentage gains dekhne ko mile, kyunki investors growth-oriented stocks mein interested the.

Top Gainers Aur Losers

Neeche kuch top gainers aur losers ki list di gayi hai:

| Stock | Performance | Sector |

|---|---|---|

| Adani Enterprises | ↑ 4.87% | SMID Cap / Energy |

| PVR Ltd | ↑ 3.92% | Entertainment / SMID |

| PI Industries | ↑ 3.45% | Agrochemicals / SMID |

| Reliance Industries | ↓ 0.80% | Energy / Conglomerate |

| ONGC | ↓ 0.65% | Energy |

| Infosys | ↓ 0.45% | IT |

Global Market Cues: US Aur Europe Ka Asar

US markets ne apne record highs ko updated karte hue global sentiment ko boost kiya. S&P 500 aur Dow Jones Industrial Average ne all-time highs hit kiye, jiska trickle-down impact Asia-Pacific markets pe dikh raha tha. US stock market updates ne Indian traders ko confidence diya, aur unhone apni positions ko expand kiya.

Europe mein bhi equity markets ne kaafi strength show ki. FTSE 100 aur DAX indices ne strong gains record kiye, jisse commodities prices mein stability mila aur risk appetite bana raha. Ye global cues ne Indian share market ko positive direction mein guide kiya.

Currency Aur Bond Market Ka Mood

Indian Rupee ne aaj thoda sa strength dikhayi, aur dollar ke mukable 0.15% ki appreciation mili. USD/INR pair 83.25 ke aas-paas trade hua. Bond yields mein mild uptick rahi, 10-year G-Sec yield 7.25% ke level pe tha. Iska matlab hai ki debt market mein thoda sa caution tha, lekin major focus equity side pe raha.

IPO Aur FPO Activity

Aaj IPO/FPO front pe zyada action nahi tha, lekin kal ek mid-sized financial services company ka IPO list hone wala hai. Upcoming IPO 2025 India se related buzz se investors thoda cautious hain, kyunki market valuations already high hain. Lekin strong pipeline dikh rahi hai aur future mein fresh capital raise ki mauka mil sakta hai.

Crude Oil Aur Commodity Market Ka Impact

Crude oil prices mein aaj thoda sa decline aya, Brent crude $78.50 per barrel ke aas-paas trade hua. Ye decline US shale supply increase aur OPEC production guidance se hua. Low crude prices ne energy stocks ko negative impact diya, lekin overall inflationary pressure reduce hua, jo CPI data ke liye positive hai.

Gold prices mein bhi aaj mild consolidation dikhaayi, aur spot gold ₹55,100 per 10 gram ke aas-paas tha. Commodity investors ne aaj safe-haven bets mein dekhaya, lekin overall theme risk-on hi raha.

Expert Views: Analysts Kya Keh Rahe Hain?

Motilal Oswal: “Aaj ka market close strong raha kyunki domestic macros stable hain aur global cues supportive the. Banking stocks abhi tak short-term catalysts ke saath outperform kar rahe hain.”

ICICI Securities: “SMID Caps mein buying interest dekhne ko mil raha hai, especially companies jo cyclical upturn se benefit kar sakti hain. Hum midcap space mein selective exposure recommend karte hain.”

Kotak Institutional Equities: “Nifty ka 24,700 resistance test karne se pehle 24,500 support dhekhna hoga. Agar US markets bhi green rahe to next week rally continue ho sakti hai.”

Technical Analysis: Nifty Aur Sensex Key Levels

Nifty Technicals:

• Support Level: 24,500

• Resistance Level: 24,700

• RSI (Relative Strength Index): 60 (neutral zone, bullish bias)

• 50-Day Moving Average: 24,200 (abhi upar break hua)

• 200-Day Moving Average: 23,800 (major long-term support)

Sensex Technicals:

• Support Level: 80,500

• Resistance Level: 81,200

• RSI: 62 (bullish sentiment)

• 50-Day MA: 80,000 (support zone)

• 200-Day MA: 78,500 (long-term support)

- “Sensex up 261 points today June 4 2025”

- “Nifty above 24,600 closing report”

- “SMID caps gain on global cues June 2025”

- “How to trade Sensex up day India”

- “Best sectors to buy Nifty bullish trend”

- “Indian stock market close highlights June 4 2025”

- “Sensex Nifty technical analysis today”

- “Top gainers and losers in Indian market June 2025”

Investor Outlook Aur Strategy

Aaj ke market close ke baad kuch cheezein dhyan mein rakhni chahiye:

- Risk Management: Agar aapne intraday ya positional trades liye hain, to stop-loss levels set karke rakhein. Market bhi volatile ho sakta hai agar global cues fluctuate karein.

- Sector Rotation: Banking aur financial stocks abhi outperformance show kar rahe hain. Lekin agar crude oil prices further niche girte hain, to energy stocks mein bargain buying dekhne ko mil sakti hai.

- SMID Caps Exposure: Aaj SMID caps ne momentum show kiya hai, lekin ye high-beta category hai. Aap small portion of portfolio allocate karke selective stocks mein long positions consider kar sakte hain.

- FII-FPI Data: NRI investors aur FPIs kya behaviour dikhate hain, ye observe karein. Agar consistent buying continue rahe to market mein bullish trend sustain ho sakta hai.

- Global Macros: US non-farm payrolls, Fed minutes, aur Europe CPI data jaise important events agle hafta dekhne ko hain. Unka impact India pe bhi dikh sakta hai.

Bullish Vs Bearish Sentiment: Indicators

Current market sentiment kaafi neutral-to-bullish hai. Kuch key indicators:

- Advance-Decline Ratio: Aaj market mein advancers > decliners the, jo positive breadth ko indicate karta hai.

- Volatility Index (India VIX): VIX 15.20 ke level pe tha, jo moderate volatility ko show karta hai. Agar VIX 14 se niche jata hai, to higher risk-on sentiment dikhai dega.

- FII/DII Activity: FIIs ne aaj net buying ki, DII (Domestic Institutional Investors) ne bhi modest buying exhibit ki. Ye combination long-term strength ka signal hai.

Conclusion: Aaj Ka Takeaway

Aaj ke market close highlights ne dikhaya ki Indian stock market resilient hai aur global cues ka positive impact tight correlations ke through mil raha hai. Sensex ne 260.74 points ka upping register kiya aur 80,998.25 pe close hua, jabki Nifty ne 77.70 points yaani 0.32% ka gain lete hue 24,620.20 pe settle hua. SMID caps ne sabse zyada momentum dikhaya, kyunki investors growth-oriented stocks mein interest dikha rahe hain.

Agar aapko short-term trading mein interest hai, to aaj ki action aapko sectors ke rotation aur market breadth se cues degi. Long-term investors ke liye, stable macros aur supportive global cues market ko sustain karne mein madadgar rahenge. Ye bhi dhyan mein rakhein ki global events jaise US Fed decisions, Europe inflation prints, aur crude oil price fluctuations aane wale dino mein market mood set karenge.

Ant me, agar aap apni investment strategy ko next level pe lena chahte hain to always risk management aur research par focus karein. Equity mutual funds, SIPs, aur blue-chip stock picks bhi ek diversified portfolio ka hissa hone chahiye. Aaj ka session bullish tha, lekin market kabhi bhi unpredictable ho sakta hai, isliye disciplined approach rakhein.

FAQs

1. Sensex aur Nifty ka aaj ka close kya tha?

Sensex 80,998.25 pe close hua (↑260.74 points, 0.32%), aur Nifty 24,620.20 pe close hua (↑77.70 points, 0.32%).

2. SMID caps kaise perform kiye?

SMID caps ne global cues se fayda uthaya aur aaj ka day unhone strong rally show ki, jahan Adani Enterprises, PVR, aur PI Industries ne double-digit gains dekhaye.

3. Kaunse sectors aaj outperform hue?

Banking, Financials, Automobile, aur Pharma sectors ne aaj achha perform kiya. Energy sector thoda weak raha due to crude oil price decline.

4. Kya global cues market ko support kar rahe hain?

Haan, US markets ne all-time highs touch kiye aur Europe indices bhi positive rahe, jisse Asia-Pacific markets mein positive sentiment raha. Indian indices ne is positive global momentum ko follow kiya.

5. Aage kya expect karein?

Agle hafta aane wale US Fed announcements, Europe CPI data, aur crude oil inventory reports market ki direction set kar sakte hain. Agar ye cues positive rahe to rally continue ho sakti hai.

Share this content:

Post Comment