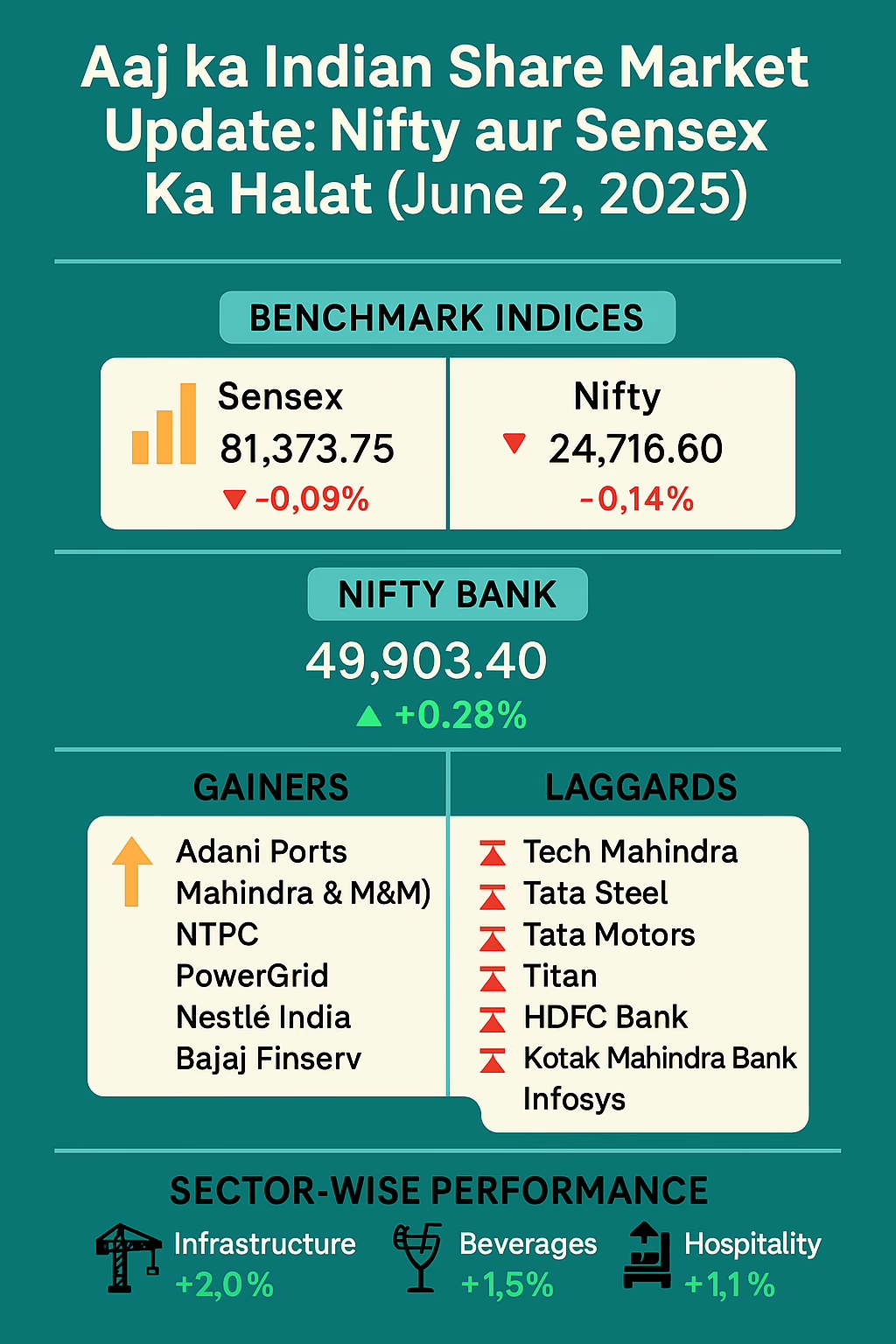

Aaj ka Indian Share Market Update: Nifty aur Sensex Ka Halat (June 2, 2025)

Introduction:

Aaj, 2 June 2025, Indian share bazaar ne ek halka sa daayara banaaya, jahan benchmark indices thode se girawat ke saath close hue. Agar aap bhi “Indian stock market update” ya “Nifty today news” ke liye search kar rahe hain, to ye article aapke liye hai. Isme hum dekhenge ki Sensex ne 81,373.75 par close kiya, jo 0.09% niche tha, aur Nifty ne 24,716.60 par close kiya, slip hone ke baad bhi 0.14% neechay gaya. Yahan par behtar market news aur share market aaj ki poori jaankaari milegi.

1. Benchmark Indices Ka Overview:

- Sensex (Bombay Stock Exchange):

Aaj Sensex 81,373.75 par settle hua, jo ki 0.09% ka girawat dikhata hai. Jab hum “Sensex today” dekhte hain, to hamare paas ek clear snapshot hota hai ki large-cap stocks ka trend kaisa raha. - Nifty (National Stock Exchange):

Nifty aaj 24,716.60 par close hua, jo 0.14% ki girawat dikhata hai. Agar aap “Nifty chart” ya “Nifty news today” search kar rahe hain, to ye number aapko real-time market sentiment batata hai. - Nifty Bank Index:

Nifty Bank ne green close dikhaya aur 55,903.40 par band hua, jo 0.28% ka gain hai. Banking sector ne aaj thodi positivity dikhayi, jabki broader market mein thoda cautious mood raha.

2. Gainers: Konsi Stocks Ne Trend Ko Tode?

Aaj ke trading session mein kuch Sensex-30 stocks ne overall market downtrend ke bawajood positive return diya. Ye stocks hain:

- Adani Ports: Adani Ports ne apni strong fundamentals aur recent order inflow ki wajah se positive momentum dikhaya. Agar aap “Adani Ports share price” search karte hain, to aaj ka 1.5% se zyada ka gain miss nahi hoga.

- Mahindra & Mahindra (M&M): M&M ke tractor aur automotive segment ki sales numbers strong aane ki wajah se stock ne acha perform kiya. “M&M stock analysis” karne par pata chalta hai ki investors ka confidence wapas aa raha hai.

- NTPC: Power generation aur Government policies ki support se NTPC ne 0.8% se zyada ka uptick diya. “NTPC share forecast” dekhne wale investors aaj ka ye move miss nahi karenge.

- PowerGrid: Transmission sector ke positive outlook ki wajah se PowerGrid ne 1% ke aas-paas gain kiya. Search keywords: “PowerGrid technical analysis”.

- Nestle India: FMCG sector mein demand stable rahne ki wajah se Nestle India ne 0.5% ka jump dikhaya. “Nestle India stock price” par nazar rakhne walon ke liye ye data useful hoga.

- Bajaj Finserv: Financial services aur insurance segment ki resilience se Bajaj Finserv ne 0.7% tak ka uptick diya. “Bajaj Finserv stock tip” jaise keywords search karne walon ke liye ye info zaroori hai.

Yeh sabhi stocks ne overall market downtrend ke bawajood apni alag chhap chhodi. Agar aap “Small cap stocks gainers” ya “Midcap picks” ki baat karte toh in mein se kuch names aapko mil jaate.

3. Laggards: Konsi Stocks Ne Market Ko Neechay Khicha?

Aaj ke inventory mein kuch heavyweight IT aur banking stocks ne market ko pull-down effect diya. Sabse zyada girne wale stocks the:

- Tech Mahindra: IT services mein global demand slowdown ki chinta ne ye stock 1.2% neeche dhakel diya. Agar aap “Tech Mahindra share volatility” search karte, to ye drop visible tha.

- Tata Steel: Metal prices mein softness aur demand ko lekar uncertainty se Tata Steel ne 1.4% ka loss record kiya. Keywords: “Tata Steel share market”.

- Tata Motors: Domestic auto sales slowdown aur export orders me dip ki wajah se Tata Motors ne 1% se zyada ki loss book ki. Search karte waqt “Tata Motors stock outlook” trending tha.

- Titan: Jewellery aur watches segment mein festive demand ki fight nahin chal payi, jisse Titan 0.9% down hua. “Titan Company stock” ko dekhne walon ko aaj ka ye trend samajhna hoga.

- HDFC Bank: Banking sector ke cautious outlook ki wajah se HDFC Bank ne 0.7% ki girawat dekhi. “HDFC Bank share price” analytics me ye dip aapko mil jayega.

- Kotak Mahindra Bank: RBI ke rate hike cues ne Kotak ko bhi 0.8% down ki taraf dhakel diya. “Kotak Bank technical chart” dekhne se pata chalta hai ki support level breach hua hai.

- Infosys: Global IT spending slowdown se Infosys ne 1% ki girawat register ki. Agar aap “Infosys stock news” search karte hain to ye result milta.

Ye sabhi “IT stock news” aur “Banking stock update” me shamil the, jinhone aaj market ko cautious banaye rakha.

4. Sector-wise Performance: Kaunse Sectors Ne Outperform Kiya?

- Infrastructure Sector:

Aaj Infrastructure sector ne sabse behtar performance di, 2% se zyada ka rise dikhaya. Is sector ko lekar “Infrastructure stocks to watch” jaise SEO keywords trending rahe. - Construction Sector:

Construction sector ne bhi 1% se zyada ka uptick dekhne ko mila. Government ke naye infrastructure projects ke cues ne is sector ko support kiya. Search terms: “Construction stock news”. - Beverages Industry (Alcoholic & Non-Alcoholic):

Dono segments ne lagbhag 1.5% ka gain dikhaya. Agar aap “Beverages companies share price” ya “FMCG stock news” search karenge, to ye data mil jayega. - Hospitality Sector:

Tourism revival aur travel season aane ki umeed se Hospitality stocks ne 1% se upar ka gain capture kiya. “Hotel stock picks” ki keywords me aaj ka ye sector highlight hua.

Is tarah, kuch niche segments ne positive momentum banaye rakha, jabki overall market flat raha.

5. Best aur Worst Performing Business Groups: Aaj Ka Data

Top Performers:

- Pennar Group: 10% se zyada ki surge.

- ADA Enterprises: 7.5% tak ka jump.

- Essar Group: 6% gain.

- Oswal Group: 6% ke aas-paas.

- Jaipuria Group: 4%+ ka advance.

Laggards:

- Sakthi (Mahalingam) Group: 2.5%+ ka decline.

- Manipal Group: 2.5% ki girawat.

- Essel Group: 2% loss.

- Hero Group: 1.6% se 1.7% slip.

- BK Birla Group: 1.6%+ ki dip.

Agar aap “Group companies share price” search karte hain, to ye names trending lists me dikhenge.

6. Aaj Ka Market Sentiment (Investor Mood):

- Risk-off Mode:

Large-cap stocks me caution dekhne ko mila. “Large cap vs midcap performance” aaj ke trade me midcaps ne better dikhaya, jisse pata chalta hai ki investors slightly risk-on mode me shift ho sakte hain. - Foreign Institutional Investors (FII) Activity:

Aaj FII net selling activity ne market par pressure dala. Agar aap “FII DII data today” search karte ho, to aaj ka net FII outflow visible hai, jo overall sentiment ko thoda cautious banata hai. - Domestic Institution Buying (DII):

DIIs ne kuch buyback ki, lekin FII selling pressure ko offset karna mushkil hua. “DII investment trends” se pata chalta hai ki DIIs moderate buying me interest dikha rahe hain.

7. Aaj Ke Key Drivers:

- Global Cues:

US market me tech stocks ka weak performance ne Asian markets ko bhi impact kiya. “Global market impact on India” se clear hota hai ki aaj ke trade me global sentiment ka bada role raha. - RBI Policy Expectations:

Rate hike ki umeedon ne banking stocks par pressure dala. Investors “RBI monetary policy” ke headlines ko closely dekh rahe hain, kyunki next policy meeting me rate hike ki sambhavna bani hui hai. - Corporate Earnings:

Q4 earnings season abhi chal rahi hai, aur kuch companies ke result disappointing aaye, jaise Tech Mahindra aur Infosys. “Q4 results impact” se pata chalta hai ki IT sector cautious raha aaj. - Commodity Prices:

Oil prices me stability ne energy sector pe mixed impact diya. Agar “Crude oil price India” search karo, to aaj ka data dekha sakta ho ki price range stable hai, lekin long-term uncertainty bani hui hai.

8. Market Outlook: Kya Expect Karein?

- Short-term Range:

Aaj Nifty 24,700–24,800 ke beech range trade karta raha. Agar aap “Nifty support resistance levels today” search karo, to key support 24,650 aur resistance 24,850 ke aas-paas dikhai dega. Agar ye levels breach hote hain, to next directional move dekhenge. - Sector Rotation:

Infrastructure aur Construction sectors aaj outperform hue. “Sector rotation strategy” ke madad se aap apni portfolio positioning dekh sakte hain. Midcaps mein diversified exposure lene par focus ho sakta hai. - Technical Indicators:

RSI aur MACD charts me neutral to slight bearish divergence dikh raha hai. Agar aap “Technical analysis Nifty” explore kar rahe ho, to aaj ka momentum thoda weak mila. Lekin agar Nifty 24,650 level hold karta hai, to bounce-back ki chance hai. - Long-term Perspective:

India ki GDP growth trajectory aur corporate profit growth fundamentals strong hain. Long-term investors “Buy and hold strategy India” follow karte hue dip ko buy kar sakte hain, kyunki India ek emerging market hote hue bhi stable growth story dikha raha hai.

10. Conclusion:

Aaj ka trading session overall flat to tha, lekin kuch specific sectors aur stocks ne alag performance di. Agar aap “Indian share market aaj” ya “market news live” search kar rahe hain, to ye article aapko ek comprehensive snapshot deti hai. Aapko ye samajhna hoga ki short-term fluctuations market ka hissa hoti hain—long-term fundamentals par nazar bana ke rakhna zaroori hai.

Also Read:

India Air Travel Market: IATA Report

Is detailed market news article ko share karke apne dosto ko bhi update rakh sakte ho. Agar aapko ye “Indian stock market update” pasand aayi ho, to below comment section mein apni raaye jaroor dein!

Disclaimer: Ye article sirf educational aur informational purpose ke liye hai. Koi bhi investment decision lene se pehle apne financial advisor se salah mashwara karein.

Share this content:

Post Comment