Tata Motors Q4 FY24 Results: JLR ne dikhaya kamaal, company bani debt-free | Retail Investors ke liye kya matlab hai?

Tata Motors, Bharat ki ek leading automobile company aur Jaguar Land Rover (JLR) ki parent company, ne apne Q4 FY24 (March quarter) ke results declare kiye 13 May ko, market hours ke baad. Results ne analysts ke expectations ko kaafi had tak beat kiya, jo retail investors ke liye ek strong positive signal hai.

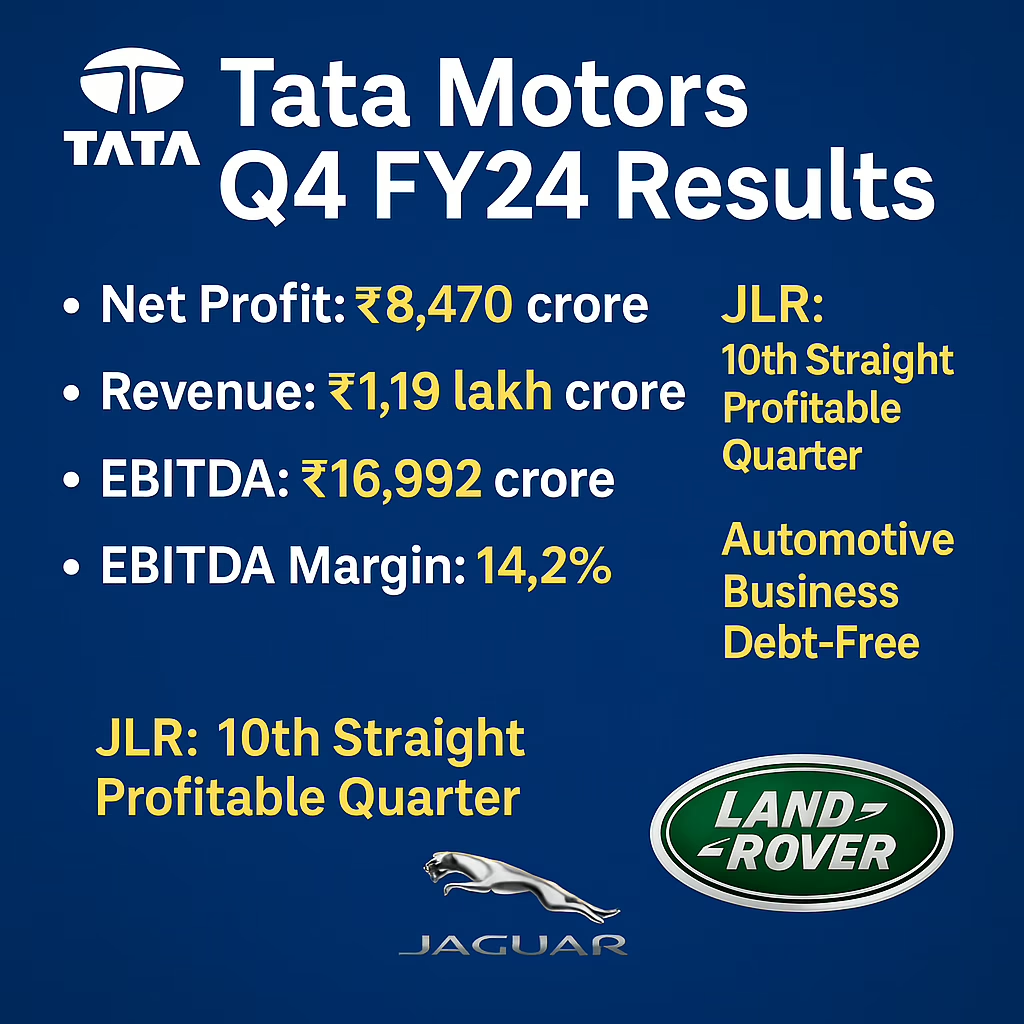

Q4 FY24 Key Highlights:

- Net Profit: ₹8,470 crore (CNBC-TV18 poll: ₹7,841 crore)

- Revenue: ₹1.19 lakh crore (Poll estimate: ₹1.23 lakh crore)

- EBITDA: ₹16,992 crore (Poll: ₹16,539 crore)

- EBITDA Margin: 14.2% (Flat year-on-year, lekin poll se better)

JLR Performance: 10th Straight Profitable Quarter

Tata Motors ki UK-based subsidiary JLR ne £7.7 billion ka revenue report kiya, jo poll expectations (£8.04 billion) se thoda kam tha. Lekin EBITDA margin 15.3% rahi, jo slightly better hai analyst estimate (15.2%) se. Sabse badi baat – ye JLR ka 10th consecutive profitable quarter tha, aur company ne FY25 ke liye apna cash-flow positive guidance bhi achieve kar liya hai.

Future Plans: £18 Billion Investment in 5 Years

JLR ne bataya ki company agle 5 saal mein £18 billion invest karegi through operational cash flows. Saath hi, wo UK government ke saath trade deal ke details par kaam kar rahe hain – jo US ke saath announce hui hai.

Tata Motors ne kiya record performance

Tata Motors ne bataya ki unka highest ever revenue aur profit before tax record hua hai. Aur sabse achhi baat – company ka automotive business consolidated basis par ab debt-free ho gaya hai. Iska matlab, future mein interest cost aur kam hogi – jo profitability ke liye acha signal hai.

Commercial Vehicle Business ka Demerger Approved

Company ke shareholders ne recently commercial vehicle business ka demerger approve kiya hai. Is move se Tata Motors ko har business unit ke full potential ko unlock karne ka mauka milega. Company ke CFO PB Balaji ne kaha, “Demerger ke saath hum har business ke potential ko realise karne ki direction mein aage badh rahe hain.”

Dividend & Share Performance

Company ne ₹6 per share ka interim dividend declare kiya hai.

Q4 results ke pehle, Tata Motors ke shares ₹708.3 par close hue – 1.7% down. Lekin stock ne apne 52-week low ₹535 se ₹150+ ka recovery dikhaya hai, jo investor sentiment ko reflect karta hai.

Retail Investors ke liye kya matlab hai?

- Tata Motors ka debt-free hona aur consistent profitability ek strong financial signal hai.

- JLR ka turnaround aur future investment plans long-term growth ke indicators hain.

- Dividend aur share price recovery retail investors ke liye attractive opportunity banate hain Tata Motors ko.

- Demerger se value unlocking ka potential hai, jo shareholders ke returns ko boost kar sakta hai.

Featured Image:

Tata Motors Q4 Results 2025, Jaguar Land Rover profits, Tata Motors dividend, Tata Motors share news, Tata Motors debt free, Tata Motors demerger update, JLR FY25 guidance, Tata Motors investment plans.

Share this content:

Post Comment